Debt waivers are supposed to help farmers make agricultural investments, repay future debts and tackle any other situation. But the history of waivers in India tells a different tale.

Credit: PTI

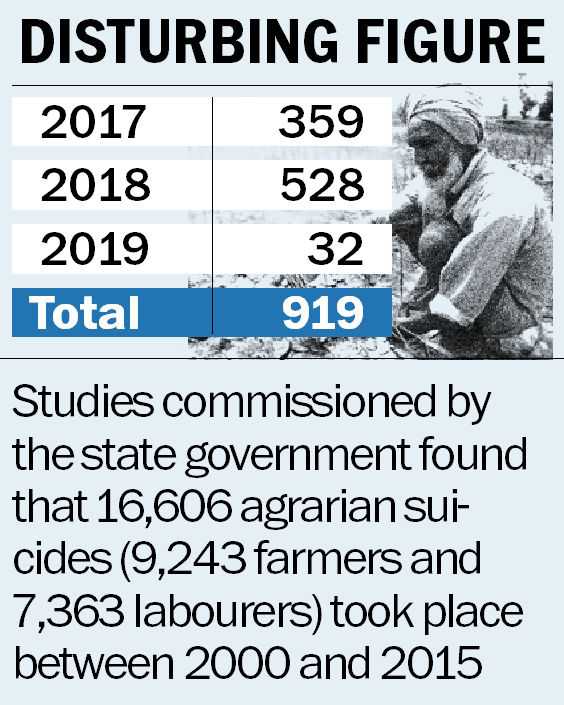

India is facing an agrarian crisis. There is no doubt that the majority of the small and marginal farmers are indebted. According to the Reserve Bank of India, the amount of outstanding loans given out for agricultural and allied activities by the regional rural banks has increased from Rs 1.80 billion in 1980-81 to Rs 1329.67 billion in 2015-16. According to the 2009 India Human Development Survey, the average outstanding loan for a household was above Rs 50,000. The most popular and yet most debated public policy response to tackle this problem of spiraling farm debts in India has been debt waiver programs.

The theoretical argument in support of debt waiver policies originated in the macroeconomic context of debt relief programs for low income countries. For instance, Bolivia received on average $614 million in foreign aid per year between 1998 and 2002 towards debt relief. These numbers went up further in recent years. Sachs, in his 1989 work, argues that a very high level of outstanding debt reduces the incentive for the debtor to exert effort to repay, a concept captured by the Debt Lafer Curve. Krugman shows that in such a situation a policy of debt forgiveness could induce the optimal level of effort from the debtor and maximise repayment. A similar logic can be borrowed in a microeconomic setting like the agricultural loan waivers. Farmers who run into huge debts, due to uncertainties associated with agriculture, are less likely to be able to come out of the debt trap without any help from outside. Debt waivers are supposed to help the farmer come out of the unforeseen situation, make agricultural investments and be able to repay future debts. The problem arises though, when we consider the specific history of farm loans waivers in India.

A typical agricultural loan contract in India uses land as collateral, which are freed once the loans are repaid. Loan waivers protect households from confiscation of their land by credit institutions in case of default. Effectively, the practice of repeated loan waivers, announced in the wake of state level elections, have contributed towards shaping an expectation among farmers about government intervention to free up their collateral in case of default. This has led to a loss of credibility in the enforcement of loan contracts between the farmers and the banks. The hope for future loan waivers is likely to have generated incentives among farmers to utilise agricultural loans for unproductive purposes and adversely affect agricultural investments.

While the debate regarding efficacy of loan waivers has gained momentum in recent times, agricultural loan waiver programs have been around for a while in India. In 1990, Prime Minister V.P. Singh announced a waiver of up to Rs 10,000 for agricultural loans per household. It cost the government Rs 100 billion to complete the waiver and it took the banks, involved in the scheme, nine years to recover the funds from the government. In the same year, the then chief minister of Haryana, Devi Lal, announced a Rs 2275 million waiver for both cooperative and commercial bank loans. In 2008, the UPA government announced one of the largest debt waiver schemes in the history of India, the Agricultural Debt Waiver and Debt Relief Scheme (ADWDRS). ADWDRS became the most prominent waiver program, at least partly because of its size – a massive Rs 716 billion. It also served as a precursor to the series of state level waiver schemes that followed. In November 2011, the Samajwadi Party government announced a debt waiver of Rs 17.20 billion for Uttar Pradesh, while the Andhra Pradesh (TDP party) and Telengana (TRS party) governments came up with their own waiver packages of Rs 240 billion and Rs 170 billion respectively in 2014-15. In 2016, the AIDMK party announced its waiver package of Rs 57.8 billion for Tamil Nadu as part of its election manifesto. Despite having the second largest fiscal deficit last year, when the BJP won the elections in UP, the state once again had a debt waiver package ready to be implemented. The BJP’s electoral manifesto had committed to write off loans of small and marginal farmers, which would approximately cost the government Rs 370 billion. The states of Maharashtra, Madhya Pradesh, Punjab, Haryana, Tamil Nadu and Gujarat are also in the pipeline to announce their own loan waiver packages, taking the cumulative loan waiver amount in the year 2016-17 to approximately Rs 3200 billion, equivalent to 2.6% of the country’s GDP.

Despite large sums of money being spent on these programs, little is known about their effectiveness. Are they really helping the farmer increase their productivity and pull them out of the debt trap?

Uttar Pradesh debt waiver scheme

To understand how potential beneficiary households respond to repeated waiver programs, we evaluated the UP Rin Maafi Yojana (UPRMY) announced in recent research (Chakraborty and Gupta 2017). Under UPRMY, a household qualified for a waiver based on the amount of loan borrowed and repaid. A timeline of the roll out of the waiver program can be seen in Figure 1.

Figure 1: Map depicting phased implementation of the UPRMY

Under the UPRMY, approximately Rs 1700 crore was disbursed as debt relief covering approximately 7.3 lakh farmers from 74 districts. The program was rolled in a phased manner over a period of three years from 2012-2015. About 42 districts received the relief package in 2012-13. In 28 districts, the program roll out happened in 2013-14. The remaining four districts received the waiver in 2014-15. Figure 2 tells an interesting story. Irrespective of which district received the waiver in which year, repayment rates fell dramatically right after the announcement of the waiver program, across all districts of UP. The average rate fell from 25%-50% in 2010-11 (pre-announcement) to 10%-25% in 2011-12 (post-announcement).

Consumption and investment behaviour of eligible vs. non-eligible households

We analyse the change in household behavior following the UPRMY using primary data collected in 2015 from 5,270 individuals in 770 households across six districts of UP. The districts were chosen to include regions from different phases of the program roll-out. Auraiya and Kanpur Dehat received the waiver in 2012-13. Agra and Firozabad received the waiver in 2013-14. We also include Lakhimpur, the only district that did not receive the waiver at the time of data collection and Sitapur, which received the waiver in 2012-13 and is adjacent to Lakhimpur. In each district a household qualifies for loan waiver if it had borrowed an agricultural loan of up to Rs 50,000 from the UP Gramin Vikas Bank. Further, the household was required to have repaid at least 10% of the borrowed amount on or before the programme announcement date.

Table 1: Household Behaviour In Response to UPRMY

| Variable |

Received Loan Waiver |

Not- Received Loan Waiver |

| Consumption |

41479 |

32728 |

| Productivity |

29397 |

38690 |

| Income |

52623 |

59051 |

Note: Consumption, is the yearly consumption expenditure in rupees; Income, is the annual income of a household; Productivity refers to the value of total production over farm size.

The average consumption value of households that received the loan waiver is roughly Rs 41,000, much higher than those of households who did not receive the waiver. This is in spite of the fact that the households that did not receive the loan waiver had a higher income and a higher level of agricultural productivity.

We delve deeper in to this apparent evidence of moral hazard using more rigorous statistical techniques. We compare differences in consumption and investment decisions between potentially eligible and not eligible households in districts that received the waiver vis-à-vis the differences between potentially eligible and not eligible households in districts that did not receive the waiver.

Our findings suggest that eligible households in districts that received the waiver had higher consumption expenditure, approximately by Rs 8,000 per year, as compared to non-eligible households. What is of greater concern is that eligible households also tend to spend significantly more on social events such as weddings, family occasions and so on. In addition, we find that eligible households had no significant productivity gain as a result of receiving the debt waiver compared to non-eligible households. Given that households in the same districts face similar agricultural shocks the insignificant productivity difference between eligible and not-eligible groups suggests a failure of the program to achieve its desired goals.

Rethinking policy interventions

Eligibility of households for loan waiver frees them up from debts and builds expectations of future credit availability. Consequently, the need to arrange for debt repayment falls. In other words, our results indicate, repeated debt waiver program have led to willful defaults. Farmers borrow from banks for agricultural investment but do not undertake the investment. Instead they use up the loan for consumption and are unable to repay the debt in the future. These findings, coupled with Figure 2 suggest that blanket waiver schemes lead households to stop repaying debts irrespective of their waiver eligibility status. This could be detrimental for the financial sustainability of this line of policy. It is important to note, however, that our findings do not speak against loan waiver programs altogether. Rather they warn against implementation of loan waiver programs based on simplistic eligibility rules that do not account for the actual needs of the farmers and the agricultural shocks they have faced. The agricultural sector in India is still vastly affected by scanty rainfall, poor irrigation facility and loans from private moneylenders with high rates of interest. A majority of the defaults could be a genuine disability to pay back due any of these reasons. However, a more thorough understanding is required regarding the effectiveness of different interventions. An alternate policy to explore is agricultural insurance which has seen an extremely low take up rate from farmers so far.

Tanika Chakraborty is assistant professor of Economics at the Indian Institute of Management, Calcutta, on leave from Indian Institute of Technology, Kanpur. Aarti Gupta, an angel investor by profession, has a Phd in Economics from IIT Kanpur, with her doctoral thesis on Loan Waivers in India.